Firmly on track to deliver our full year guidance

Athens, Greece – November 7, 2023 – GR. Sarantis S.A. (SAR.AT, SAR:GA) announces its nine-month trading update for the period ended September 30th, 2023.

Nine months 2023 highlights:

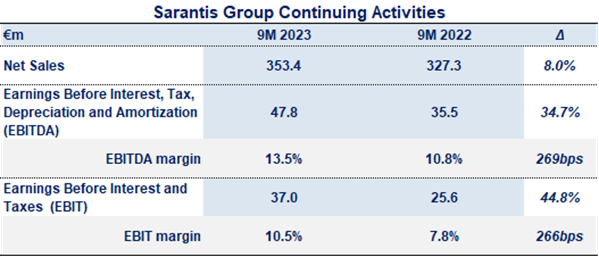

- 9m 2023 Net Sales grew to €353.4m vs €327.3m in 9m 2022, higher by 8.0% illustrating the focused execution of the Group’s strategic priorities along with targeted revenue growth management initiatives.

- 9m 2023 Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) showed a significant rise of 34.7% reaching €47.8m compared to €35.5m in the corresponding period of 2022, with EBITDA margin strengthening to 13.5% (vs 10.8% in 9m 2022) up by 269bps.

- Earnings Before Interest and Tax (EBIT) grew by 44.8% to €37.0m in 9m 2023, compared to the 9m 2022 EBIT of €25.6m. EBIT margin grew to 10.5% in 9m 2023 in comparison to 7.8% in 9m 2022. Comparable EBIT margin grew 266 basis points year-on-year highlighting strong operating leverage from top-line growth.

- Committed to the implementation of the Group’s strategic growth agenda to drive business forward, based on the three pillars: strong growth – sustainable organic growth with acquisitions coming on top, simplification and efficiency to unlock value and release energy in the organization and organizational capability by skills upscaling and leadership development.

- Emphasis and continued investment behind our HERO product portfolio, the Group’s high-value core brands across its strategic categories, which drive profitability and sustainable growth for the business.

- We reiterate our guidance for FY 2023, as our business performance year-to-date gives us the confidence that we can deliver on our raised 2023 outlook.

Giannis Bouras, Deputy Chief Executive Officer of Sarantis Group, commented on the 9m 2023 results:

“Remaining focused on the execution of our strategic growth agenda and on our core categories, we delivered a solid performance during this trading period. The benefits emerging from our commitment to investing in Beauty & Skin Care, Personal Care, Home Care Solutions and Strategic Partnerships categories, signal the effectiveness of our focused approach.

As we are moving towards the end of 2023, our business performance year-to-date gives us the confidence that we can deliver on our raised 2023 guidance.

Overall, these results are a testament to our people’s energy, dedication and commitment across our markets and the Group and I want to thank them all for their ongoing support.”

* Items in the comparable period of the nine-month period of 2022 correspond to the Group's continuing operations excluding the contribution of ELCA Cosmetics Ltd, as the Group's participation was sold on June 15, 2022, and excluding the contribution of the Group's subsidiary Hoztorg LLC, as the company decided to permanently withdraw from the Russian market.

**EBITDA: Alternative Performance Measure as defined in the Semi-Annual 2023 Financial Report.

|

Business Outlook |

Our 2023 guidance remains unchanged. While we retain our attention to macroeconomic and geopolitical risks, we are confident that our strategy and execution will fuel sustainably our growth momentum. Thus, we continue to expect:

- net sales for the full year to be at €480m, increased by 7.8% in comparison to 2022 (€445.1m).

- organic EBIT growth at €43m for 2023, an increase of 33.4% compared to EBIT 2022 (€32.2m).

- EBIT margin at 8.9% for 2023 expecting it to grow by 166 basis points from 2022 (EBIT margin 2022: 7.2%).

|

Disclaimer |

This document contains certain “forward-looking” statements. These statements are based on management’s current expectations and are naturally subject to uncertainty and changes in circumstances, which could affect materially the expected results, because current expectations and assumptions as to future events and circumstances may not prove accurate. Our actual results and events could differ materially from those anticipated in the forward-looking statements for many reasons, including the risks described in the 2022 Annual Financial Report of GR. Sarantis S.A. and its subsidiaries. This document serves only informative purposes and does not form or can either be referred to as a buy, sell or hold encouragement for shares or any other fixed income instruments. Investors must decide upon their investment actions based on their own investing preferences, financial status and advice from those registered investment advisors who consider appropriate.

Although we believe that, as of the date of this document, the expectations reflected in the forward-looking statements are reasonable, we cannot assure you that our future results, level of activity, performance or achievements will meet these expectations. Moreover, neither we, nor our directors, employees, advisors nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements.