Despite the unprecedent challenges posed by the COVID-19 crisis, the Group followed its strategic expansion plan and managed to generate profitable growth and additional value to the shareholders delivering on its commitments.

During FY 2020, the Group delivered another 10-yr record EBITDA margin, that reached 15.94%, while sustaining a strong sales growth momentum of 6.3% yoy. This reflects the agility and resilience of the Group’s business model, its product and geographical diversification, and its ability to respond quickly to the unprecedented challenges posed by the COVID-19 pandemic.

Throughout the year and across the Group’s region growth was driven by product categories related to personal hygiene, health care and home care, underpinned by the Group’s ability to address different consumption patterns and channel dynamics in each country.

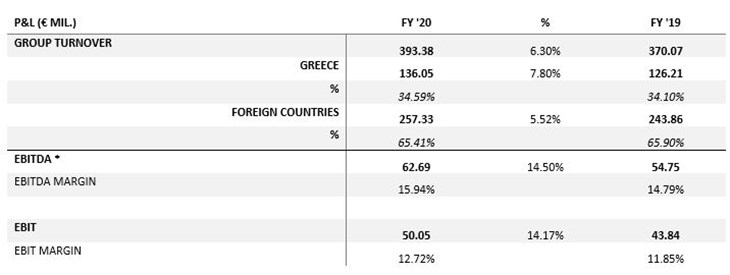

More specifically, during FY 2020 the Group’s turnover reached €393.38 million from € 370.07 million in 2019, up by 6.30%.

Greece, presented sales of €136.05 million in FY 2020 compared to €126.21 mil. in FY 2019, up by 7.80%.

The foreign countries, exhibited growth of 5.52% reaching €257.33 million in FY 2020 from €243.86 million in 2019.

The Group’s profitability in FY 2020 benefited by the optimization of operating costs and lower advertising and promotion expenses across our geographical region, although a part of the marketing investment, that was controlled during the first half of the year, was reactivated during the second half of the year in order to support selected strategic initiatives.

Specifically, during FY 2020 EBITDA* was up by 14.50% to € 62.69 mil. from € 54.75 mil, with the EBITDA margin of 15.94% from 14.79% last year.

Earnings Before Interest and Tax (EBIT) increased by 14.17% reaching € 50.05 mil. in FY 2020 versus €43.84 mil. in FY 2019 and EBIT margin reached 12.72% in FY 2020 from 11.85% in the 2019.

*Alternative Performance Measures, as defined within the relevant paragraph of the Group’s Financial Report.

While the outlook for the global economy in 2021 remains uncertain and the vaccination process is at its initial stages, we are encouraged by our resilient performance in 2020, our strong financial position and cashflow generation. As we continue to make progress on our strategic priorities, we feel more and more confident for the future and our ability to emerge stronger and continue our expansion plan stimulating further profitable growth and value to our shareholders.

It is noted that the Group will publish its Full Year 2020 Consolidated Financial Results and 2020 Annual Financial Report on April 8th 2021 .

Sarantis Group

Headquartered in Athens and boasting a history of over 50 years, Sarantis Group is a multinational consumer products company having leading presence in Eastern Europe and an expanding geographical footprint through own subsidiaries and strong export activity worldwide. From Personal Care, Home Care and Health Care Products as well as Luxury Cosmetics, the Group offers well recognized brands that consumers love and trust in their everyday lives. With strong activity in 13 countries, and in particular in Greece, Poland, Romania, Bulgaria, Serbia, Czech Republic, Slovakia, Hungary, Northern Macedonia, Bosnia, Portugal, Ukraine and Russia, the Group maintains its dynamic international presence and a powerful distribution network of more than 50 countries around the world.

Information

Eleni Pappa

Investor Relations & Corporate Communications Director

Email: epappa@sarantisgroup.com